UPDATE 09/09/2013

My full review of Square Register is much more up-to-date, but the post below is here for historical purposes.---After a year of using the combination of Ring It Up (RIU) and the Innerfence Credit Card app as my "mobile cash register" (see my blog post from Jan 2010), I have noticed some competition. But why would I consider switching to something else?

- Fees suck. Monthly fees, cancellation fees, re-activation fees, PCI compliance fees, multiple fees per transaction. I'm reminded of the taxman from the 1980 movie "Popeye".

- Innerfence charges $79 for their hardware credit card reader (unless you're a brand new customer, which I ain't no more!)

- The Innerfence solution isn't just a single company:

- I was required to set up accounts with Authorize.net (payment gateway), and Merchant Focus (merchant account). When you sign up, you fill out one big set of paperwork. It's convenient that it's "one big set of paperwork", but it's like getting a mortgage: The EULA totals to about 15 pages in 12-point single-spaced type, written completely in LawyerSpeak. Then when it's filled out, you have to fax it all back. (It's the 21st Century, folks. Why the hell do fax machines still exist? They use the landline telephone network, which defeats the purpose of me using a mobile phone, which is the platform I'm using to run the very app I'm being required to fax all this paperwork for! Think about it!)

- Merchant Focus (or was it Authorize.net, I don't remember who does what..), didn't allow me to take American Express. I had to contact Amex on my own and create a merchant account with them -- yet a THIRD company to deal with. Then they charged me $7.95 a month whether I had transactions or not. (They are kinda nifty though.. One of the perks of signing up for American Express is that they give you free "American Express accepted here" signs to display at your location. Yeah, they're made of metal, and I'm totally keeping those!)

- If you cancel your service however, you have to contact each company separately. But when you call to cancel your respective accounts, that's when the companies start getting all sweet on you: Amex was willing to eliminate my monthly fee all together (but increase my transaction rate), and Merchant Focus was willing to reduce my monthly rate from $10.00 to $5.00. (I guess in order to get the best rates, you're supposed to use them for a few months, then threaten to cancel your account.)

---Recently, some challengers have entered the arena: Intuit's GoPayment, and a little thing called Square.DISCLAIMER: When I mention how the fees for the following solutions are so much "better" than those offered by Authorize.net / Merchant Focus, they are better for my financial situation. If you are considering any of these services, calculate some estimated transactions to see which solution is best for you. You will need the following: total number of transactions per year, average cost of each transaction, active number of months (if you run a seasonal business). Even though one solution might be less expensive in the long run, personally I find (albeit, intangible) value in not having to pay monthly fees, and not having to manage accounts with several different companies at once.

Intuit GoPayment

I haven't yet signed up, so this review won't be as in-depth as it could be.

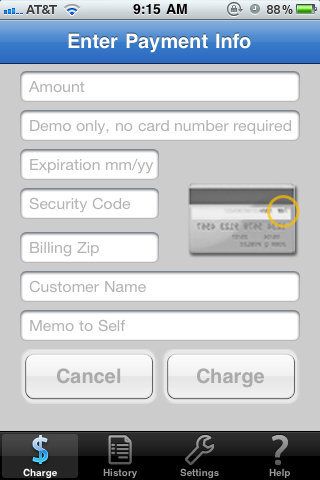

Intuit, an 800-pound gorilla of the personal/business financial solution market (makers of Quicken, Quickbooks, TurboTax, and the wickedly-cool mint.com) has decided -- along with most of the modern world -- that the smartphone universe is the kickin' place to be. They have an app called GoPayment, which works on pretty much everything: iPhone/iPad, Android, Blackberry, and Win7 phones.It's a two-prong approach, in that you have an app and a hardware card reader. They offer their little white card reader for free, but they also offer the Mophie card reader for iPhone users. (Is the Mophie reader free too?) Once the app starts (and once you've logged into the service), you are presented with the payment screen:

Once the app starts (and once you've logged into the service), you are presented with the payment screen: Upon completing a transaction, it gets entered in the "Past Charges" screen:

Upon completing a transaction, it gets entered in the "Past Charges" screen: The app also offers a rudimentary inventory list:

The app also offers a rudimentary inventory list: And by rudimentary, I mean it doesn't have very many features: Name, Description, Price, Tax. (That's all you're getting.)

And by rudimentary, I mean it doesn't have very many features: Name, Description, Price, Tax. (That's all you're getting.) Before I move on, let's compare that to Ring It Up, shall we?(I just felt like doing that... anyway)How much does GoPayment cost?

Before I move on, let's compare that to Ring It Up, shall we?(I just felt like doing that... anyway)How much does GoPayment cost? Pros:

Pros:

- NO MONTHLY FEES!* (I'm looking at you, Innerfence..)

- The connection to QuickBooks is (probably) a lot more convenient than having to fiddle with CSV files in Excel. (I say "probably" because I don't have Quickbooks.)

Cons:

- Except for syncing with Quickbooks, there's no API and therefore no connection to other apps (..my precious Ring It Up!)

- Something about the interface is kinda ugly, and I can't put my finger on it. (It reminds me of Windows 3.1 for some reason..)

- Intuit requires a credit check when you sign up.

- I know they're trying to cover themselves, but eh..

- (UPDATE:) They accept American Express, but you're charged Amex's fees instead of Intuit's

- * - Monthly fees for "high volume accounts" eh?

- The point-of-sale/inventory features are extremely limited compared to what I've become accustomed to with the Ring It Up app. (Just for kicks, let's post the photos again: GoPayment ... Ring It Up. This is fun!)

---

Square

I have already signed up for Square, so this will be a more in-depth review.

(UPDATE: 04/19/2011) - As of version 1.6, the Square app for iPhone supports sales tax! No more fiddly calculations! They also changed the interface, so my screenshots are out-of-date.Everybody has heard of Twitter, right? Well, one of their founders, Jack Dorsey apparently became so frustrated at how complicated and expensive credit card processing is for a small business that he decided to show them all how it's done.https://squareup.comJust like GoPayment, it's also a hardware/software solution. Their (iconic) card scanner plugs into your headphone jack, and the app is written for both iOS and Android. You start the app, and (assuming you're logged into the service) it's ready to take your transaction info:

You start the app, and (assuming you're logged into the service) it's ready to take your transaction info: You enter a price, then (if you want) you can enter the name of the thing you are selling. Also, click the little camera icon and take a photo of what you're selling.Problem: if you have items with long names, you'll be doing a lot of cumbersome typing -- there's no quick way to automatically enter this information (unless you have the iPad app). But if you have a photo of the item, you can include it next to the description (once again, it's no Ring It Up, but it works):

You enter a price, then (if you want) you can enter the name of the thing you are selling. Also, click the little camera icon and take a photo of what you're selling.Problem: if you have items with long names, you'll be doing a lot of cumbersome typing -- there's no quick way to automatically enter this information (unless you have the iPad app). But if you have a photo of the item, you can include it next to the description (once again, it's no Ring It Up, but it works): (Square finally has an entry for sales tax on the iPhone app! This screenshot is out of date.)

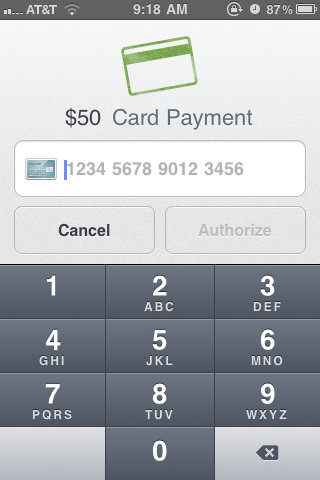

(Square finally has an entry for sales tax on the iPhone app! This screenshot is out of date.) If you haven't received your "square" card reader, you can manually key the card number. This costs extra.

If you haven't received your "square" card reader, you can manually key the card number. This costs extra. Here's an interesting thing: The interface lets you know about your limit:[old screenshots removed]UPDATE (a while back..) -- Square changed their limits! If you actually swipe the customer's card, Square won't hold your transactions very long. But if you hand-type the credit card number, and those hand-typed transactions total over $1,000, then they'll wait 30-days to give it to you.Once a transaction goes through, you can email the receipt to your customer. And if you enable Location Services, the receipt will include a map of where the purchase was made! Snazzy!Pros:

Here's an interesting thing: The interface lets you know about your limit:[old screenshots removed]UPDATE (a while back..) -- Square changed their limits! If you actually swipe the customer's card, Square won't hold your transactions very long. But if you hand-type the credit card number, and those hand-typed transactions total over $1,000, then they'll wait 30-days to give it to you.Once a transaction goes through, you can email the receipt to your customer. And if you enable Location Services, the receipt will include a map of where the purchase was made! Snazzy!Pros:

- The most simple pricing structure on the planet.

- NO MONTHLY FEES.

- 2.75% per transaction. Done. That's it. "One Fee To Rule Them All!" **

- Nice looking interface, slick animation

- No credit check during application process

- Accepts American Express without a separate contract

- Cute little scanner!

Cons:

- ** - Manually-keyed transactions are a higher rate: 3.5% + 0.15 cents. (so be sure to use your card scanner as often as possible)

- No inventory management (unless you have the iPad version.. which I don't, so I can't do my snarky screenshot comparison like I did with GoPayment)

- With the iPhone version, I have to manually enter the item description for every. single. transaction.

- UPDATE! I tested the Square app on an iPad for a week. I meticulously entered a bunch of items, and looked forward to the next show when I could happily click on those items instead of hand-typing them in while the customer is standing there waiting for me to get done hand-typing them in -- but alas! For whatever reason, the app forgot about most of my items! Yes, I started up the app, and most of the stuff that I typed in was GONE! (Granted, this was about six months ago. Let's hope they've fixed this.)

- It's a mostly-closed system (even if you have the iPad version!)

- No automatic data input -- It doesn't have an API, and therefore doesn't talk to other apps.

- That means it doesn't replace the Innerfence app: I can't use RingItUp for inventory management / point-of-sale and then press the magic button in RIU to feed the payment info to the Square app for processing.

- The author of RIU is patiently waiting for Square to release an API, but they're being awfully slow about it.

- Limited data output -- It allows you to download a CSV from the website, but like with any CSV, you'll have to fiddle with the formatting to properly merge it with your existing financial data.

- No automatic data input -- It doesn't have an API, and therefore doesn't talk to other apps.

- Can't delete test transactions from the website.

- Now this is just plain silly. What good is a list of data when it has invalid results in it?

* I didn't want to have to buy an iPad just for a single app. (Why those features couldn't also be in the iPhone version, I have no idea.)---(UPDATE 03/15/2011) - On March 9, Verifone's CEO let the world know how insecure and "dangerous" Square's little card reader is.When using Square, the credit card data is not encrypted until it gets to the app. (However, it is encrypted before it's transmitted over the internet, or else it wouldn't be PCI compliant.) This means someone could write a malicious app (like the one Verifone demonstrated the video) that allows the vendor to keep the customer's card information and use it for nefarious purposes, if they so choose.Scary, eh? Do you know what's also scary?

- Old-school knucklebusters don't encrypt card data either! A vendor could simply read the imprinted card number right off the sheet of paper! OMG!! (And vendors are required to keep those imprinted sheets for three years.)

- Anybody could buy a USB credit card reader off the internet and pretend like they're a business.

- If you're in a restaurant, and you hand your credit card to the waiter, what happens when they "walk off to the back room" with it? You think you just paid for dinner, but they might be back there using your card to buy a case of iPads to send them overseas for profit. Who knows! OMG, get your tinfoil hat ready!

This is what we in the industry refer to as FUD - "fear, uncertainty, and doubt." Verifone is scared of Square's business model and is doing anything it can to stay afloat.---

Conclusion

How do I feel about these two solutions?While writing this review, I realized how spoiled I've become by all the features in Ring It Up, and how it seamlessly talks to the Innerfence app. I'm dead-set on using RIU, and neither one of these platforms has enough point-of-sale features to pry it out of my hands.

- So, I guess the first part of this review is to see which one is the most compatible with RIU.

- On that front, they both fail -- Neither one has an API for sharing data between apps.

- Fees:

- They're both whooping Innerfence quite handily.

- Even where GoPayment has a monthly fee for high volume accounts, it's still $12.95/month where Innerfence is $25/mo. (Square doesn't charge extra if I exceed $1,000/week, but it doesn't give me a fee discount either.)

- Square processes American Express at the same rate as everything else. (Unless Amex is in a generous mood all of a sudden, their rates are usually higher.)

- -- Winner by a knife-edge: Square.

- Features:

- GoPayment has basic inventory management, but so does the iPad version of the Square app. (But since I don't have an iPad, I have no idea how robust the feature set really is. There's a slim chance that it could supplant RIU, but I'm doubting it.)

- ...I'm getting the impression Square really wants me to buy an iPad. I'm considering it, but the first app I'm getting is the HD version of RIU. Then I guess I'll get Roambi. Square, you'll be third out of spite.

- -- Winner by a technicality: GoPayment.

- Interface:

- I'm sorry Intuit, but you guys have to 'pretty it up' a little. Your app isn't quite as "lickable" as the Square app. (On an iPhone, the prettiest app wins.)

- -- Winner, assuming that I enjoy slobbering over my phone: Square.

I may have already made my decision by signing up for Square first, but I don't know.. They're really close. If one of them can either get an API going, or boost their inventory management features to supersede Ring It Up, that would make it a lot easier for me to make a decision. And since there's no disconnect fee for Square, it would be easy to jump ship if I have to.Competition is a beautiful thing, and both of these services represent the new way of processing credit card transactions. No matter which of these services comes out on top, I'm so glad they are teaming up on the "old school" ways of doing things. There's no reason this needs to be complicated.